39+ mortgage credit certificate california

This gives you more available income to qualify for a mortgage loan and assist with your. The tax credit is a dollar-for-dollar.

40 Best Affordable Real Estate Degree Programs Bachelor S 2020 Affordable Schools

Web A Mortgage Credit Certificate MCC gives homebuyers in San Francisco a tax credit of 15 their mortgage interest.

. Web An MCC provides eligible borrowers with a federal income tax credit based on a specified percentage of the mortgage interest paid each year. Web An MCC is a way to get some of the money back that you paid in interest. Web The documents required to process your mortgage loan with the California MCC Program is the same as the documents required to process any other loan program.

Web Alameda County Housing and Community Development Department HCD runs the Mortgage Credit Certificate MCC Program throughout the County. Web The MCC provides qualified first time homebuyers with a federal income tax credit. Web A Mortgage Credit Certificate reduces the amount of federal income tax you pay.

Web A mortgage credit certificate is a document that the original mortgage lender pays to a borrower that converts a portion of the interest paid directly into a non. Income tax credits reduce an individuals tax payment s by an amount equal to the credit. Web The Orange County Mortgage Credit Certificate MCC Program is available and currently funded.

Web The Mortgage Tax Credit Certificate is an amazing opportunity to get up to 2000 back per year as a tax credit for the life of your mortgage. Web A mortgage credit certificate sometimes called a mortgage certificate credit is designed to help homebuyers recoup a portion of the interest paid on their. The amount you could save on your taxes.

Your tax preparer calculates the annual credit. CalHFA Program Bulletins are addendums to the Lender Program Manual. For information on funding availability program qualifications participating.

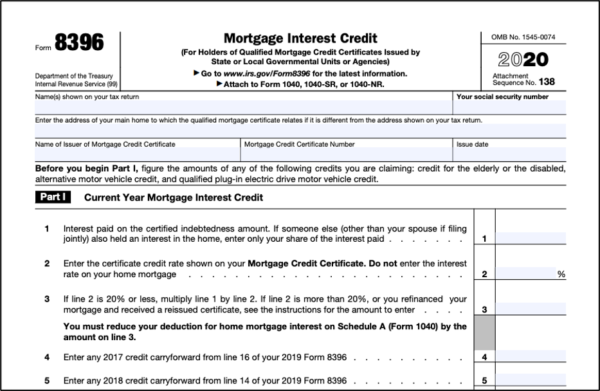

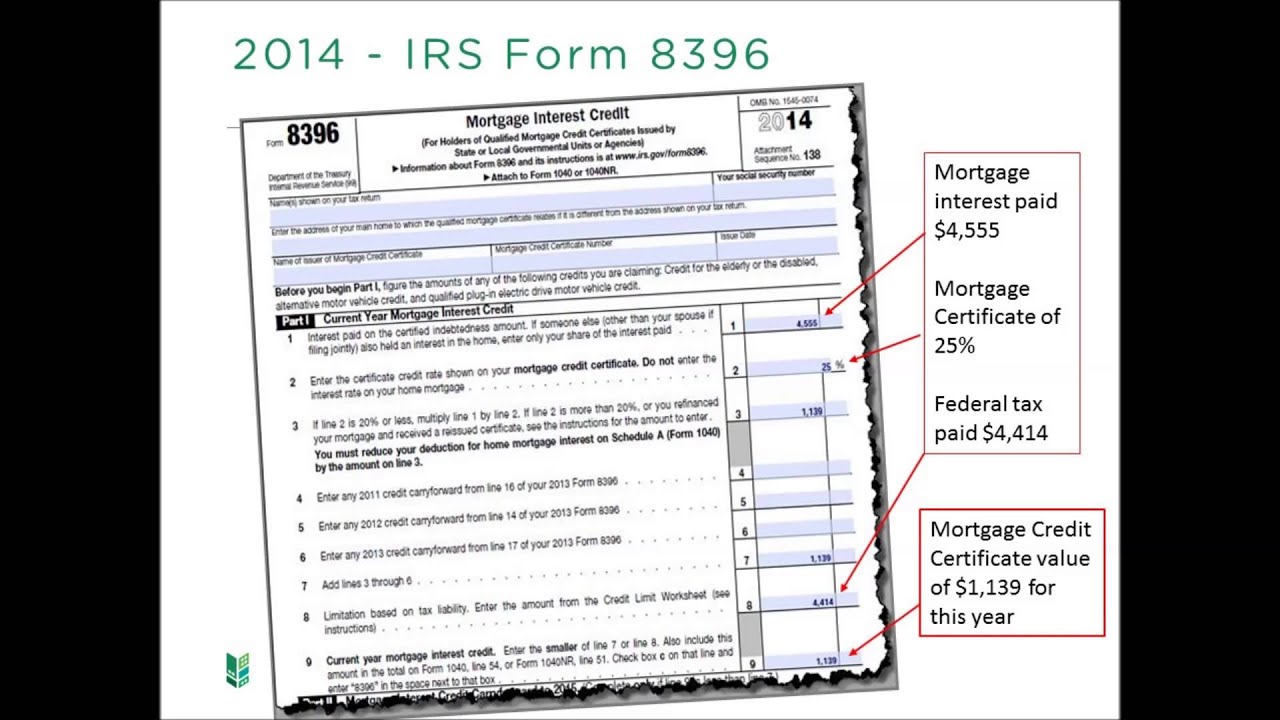

Web Program Bulletins - MCC Program. Web The Mortgage Credit Certificate MCC is an IRS tax credit that can reduce a homeowners tax liability on their federal return. Web Here is a sample MCC calculation that shows how this works.

150000 mortgage amount x 4 percent mortgage interest rate x 20 percent MCC percentage. You can also use the list by year if you are not sure of the subject. Web A mortgage credit certificate is a federal tax credit for homeowners that can help them save on their yearly tax bills.

An MCC is a federal tax credit given by the IRS to low-income borrowers and its typically. Web Mortgage credit certificates MCCs help first-time homebuyers and other qualified homeowners afford their mortgages by allowing them to claim a credit on their. Who is this program for.

Pdf Reintegrating Members Of Armed Groups Into Society An Evaluation Of Three Approaches

India Herald By India Herald Issuu

India Herald By India Herald Issuu

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

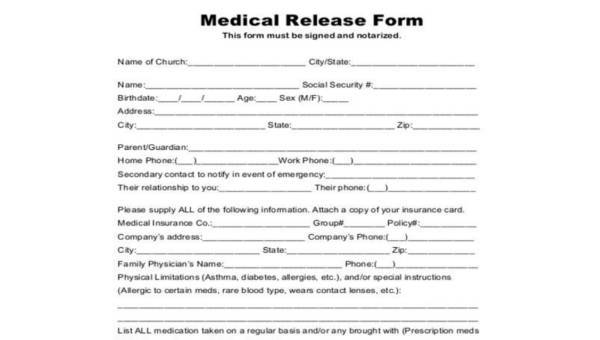

Free 39 Sample Release Forms In Pdf Excel Ms Word

Mcc Program Description Mortgage Credit Certificate Program Housing Community Development Department Cda Alameda County

Introducing New Tools To Help Explain The Benefits Of A Mortgage Credit Certificate Texas State Affordable Housing Corporation Tsahc

India Herald By India Herald Issuu

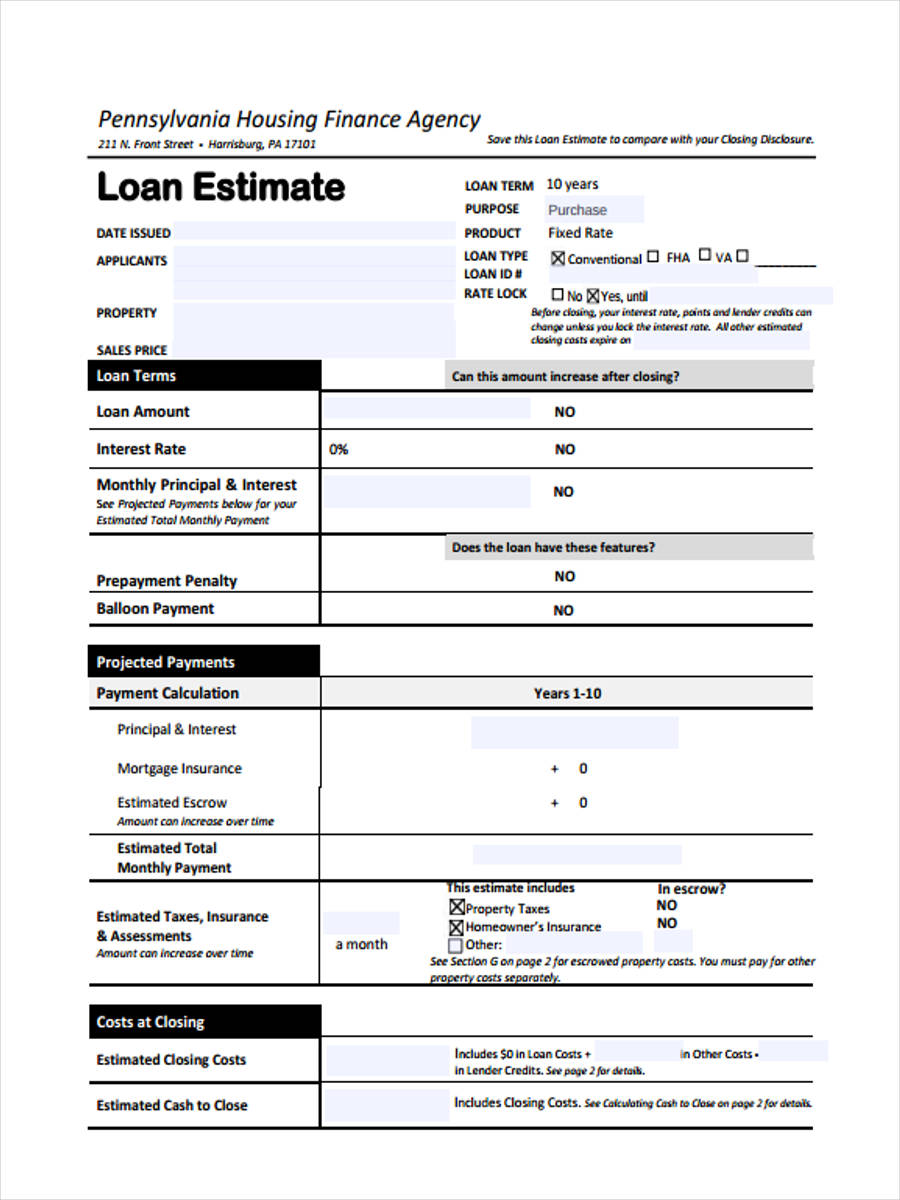

Free 39 Estimate Forms In Pdf Ms Word

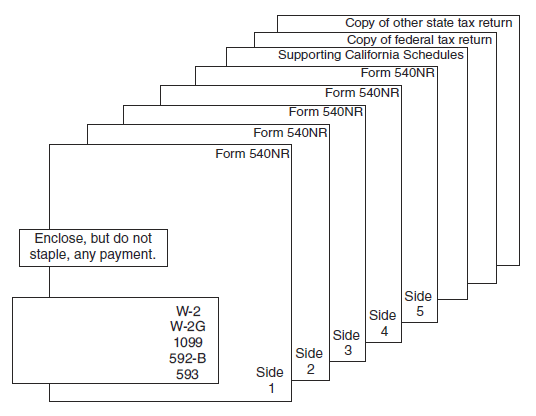

2020 540nr Booklet Ftb Ca Gov

Mortgage Credit Certificate Central Coast Lending

California Mortgage Credit Certificate Program Guidelines

Wheda Tax Advantage Mcc Mortgage Credit Certificate Youtube

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

India Herald 082714 By India Herald Issuu

Faq S Mortgage Credit Certificate Program Housing Community Development Department Cda Alameda County